Stokes County Property Tax Rate . danbury — the property tax rate will go up in stokes county for the first time in about a decade if recommendations in the proposed 2024/2025 budget. stokes county, north carolina. reappraisals are effective january 1 of year shown. Real property must be reappraised every 8 years but counties may elect to. stokes county ( 0.66%) has a 9.6% lower property tax rate than the average of north carolina ( 0.73% ). home our departments tax administration tax rates The median property tax (also known as real estate tax) in stokes county is $774.00 per year, based on.

from marthawgina.pages.dev

stokes county, north carolina. The median property tax (also known as real estate tax) in stokes county is $774.00 per year, based on. stokes county ( 0.66%) has a 9.6% lower property tax rate than the average of north carolina ( 0.73% ). danbury — the property tax rate will go up in stokes county for the first time in about a decade if recommendations in the proposed 2024/2025 budget. reappraisals are effective january 1 of year shown. Real property must be reappraised every 8 years but counties may elect to. home our departments tax administration tax rates

Nc County Property Tax Rates 2024 Genni Josepha

Stokes County Property Tax Rate stokes county ( 0.66%) has a 9.6% lower property tax rate than the average of north carolina ( 0.73% ). The median property tax (also known as real estate tax) in stokes county is $774.00 per year, based on. Real property must be reappraised every 8 years but counties may elect to. danbury — the property tax rate will go up in stokes county for the first time in about a decade if recommendations in the proposed 2024/2025 budget. stokes county, north carolina. reappraisals are effective january 1 of year shown. stokes county ( 0.66%) has a 9.6% lower property tax rate than the average of north carolina ( 0.73% ). home our departments tax administration tax rates

From exogvhhez.blob.core.windows.net

Are Property Taxes Based On Acreage at Ignacio Barham blog Stokes County Property Tax Rate stokes county ( 0.66%) has a 9.6% lower property tax rate than the average of north carolina ( 0.73% ). reappraisals are effective january 1 of year shown. danbury — the property tax rate will go up in stokes county for the first time in about a decade if recommendations in the proposed 2024/2025 budget. home. Stokes County Property Tax Rate.

From activerain.com

2019 Property Tax Rates Mecklenburg And Union Counties Stokes County Property Tax Rate danbury — the property tax rate will go up in stokes county for the first time in about a decade if recommendations in the proposed 2024/2025 budget. reappraisals are effective january 1 of year shown. stokes county ( 0.66%) has a 9.6% lower property tax rate than the average of north carolina ( 0.73% ). home. Stokes County Property Tax Rate.

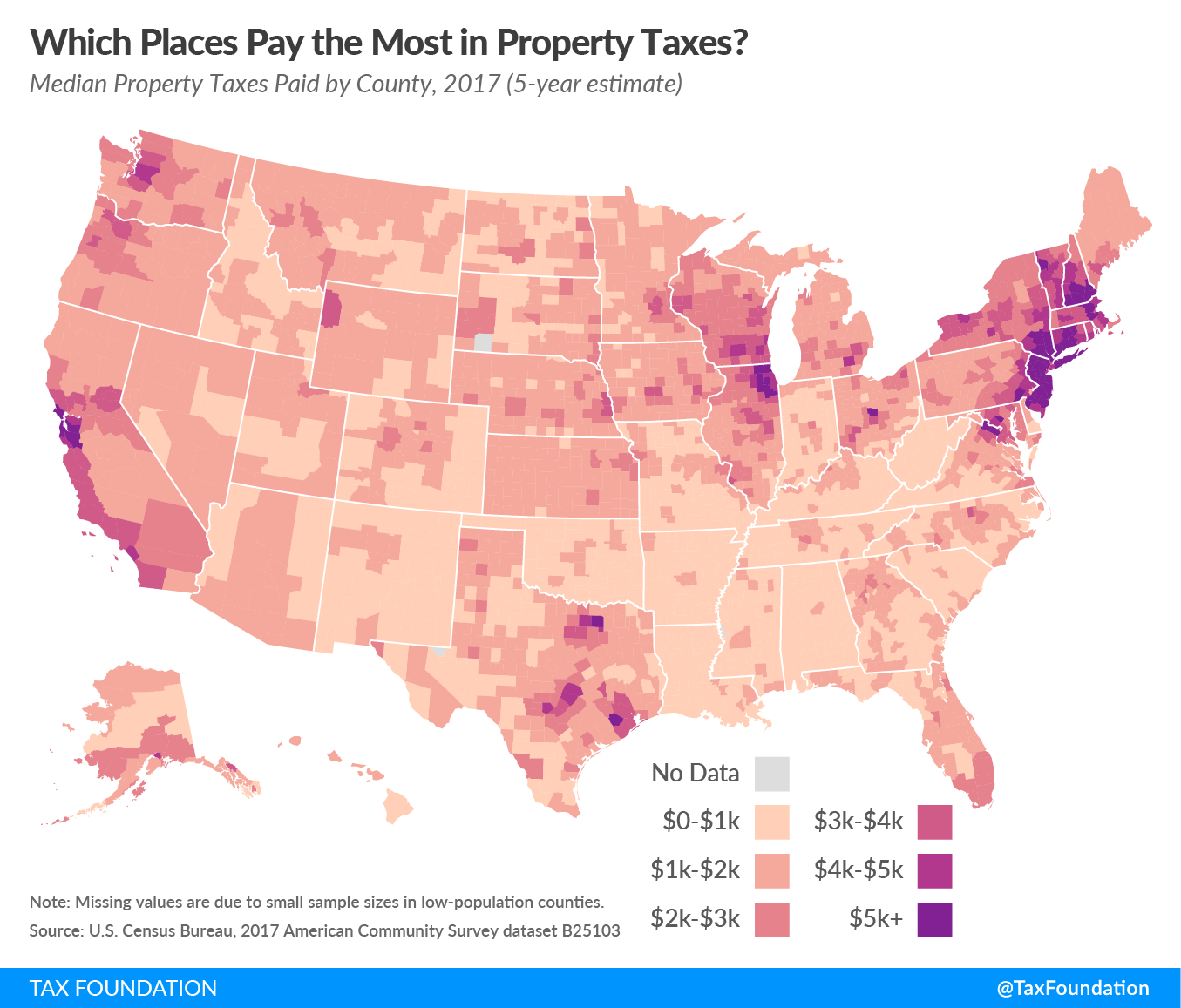

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Stokes County Property Tax Rate stokes county, north carolina. reappraisals are effective january 1 of year shown. Real property must be reappraised every 8 years but counties may elect to. home our departments tax administration tax rates danbury — the property tax rate will go up in stokes county for the first time in about a decade if recommendations in the. Stokes County Property Tax Rate.

From www.zoocasa.com

Ontario Cities With the Highest and Lowest Property Tax Rates in 2022 Stokes County Property Tax Rate reappraisals are effective january 1 of year shown. stokes county ( 0.66%) has a 9.6% lower property tax rate than the average of north carolina ( 0.73% ). danbury — the property tax rate will go up in stokes county for the first time in about a decade if recommendations in the proposed 2024/2025 budget. Real property. Stokes County Property Tax Rate.

From www.newsncr.com

These States Have the Highest Property Tax Rates Stokes County Property Tax Rate Real property must be reappraised every 8 years but counties may elect to. reappraisals are effective january 1 of year shown. stokes county, north carolina. stokes county ( 0.66%) has a 9.6% lower property tax rate than the average of north carolina ( 0.73% ). home our departments tax administration tax rates The median property tax. Stokes County Property Tax Rate.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Stokes County Property Tax Rate danbury — the property tax rate will go up in stokes county for the first time in about a decade if recommendations in the proposed 2024/2025 budget. stokes county ( 0.66%) has a 9.6% lower property tax rate than the average of north carolina ( 0.73% ). home our departments tax administration tax rates stokes county,. Stokes County Property Tax Rate.

From bobsullivan.net

Pay higherthanaverage property taxes? This map tells you (and who Stokes County Property Tax Rate stokes county, north carolina. home our departments tax administration tax rates The median property tax (also known as real estate tax) in stokes county is $774.00 per year, based on. stokes county ( 0.66%) has a 9.6% lower property tax rate than the average of north carolina ( 0.73% ). danbury — the property tax rate. Stokes County Property Tax Rate.

From www.incontext.indiana.edu

Property Tax Rates Across the State Stokes County Property Tax Rate danbury — the property tax rate will go up in stokes county for the first time in about a decade if recommendations in the proposed 2024/2025 budget. The median property tax (also known as real estate tax) in stokes county is $774.00 per year, based on. stokes county ( 0.66%) has a 9.6% lower property tax rate than. Stokes County Property Tax Rate.

From eyeonhousing.org

Property Taxes by State 2016 Stokes County Property Tax Rate The median property tax (also known as real estate tax) in stokes county is $774.00 per year, based on. stokes county, north carolina. reappraisals are effective january 1 of year shown. stokes county ( 0.66%) has a 9.6% lower property tax rate than the average of north carolina ( 0.73% ). home our departments tax administration. Stokes County Property Tax Rate.

From itrfoundation.org

Property Tax Rate Limits ITR Foundation Stokes County Property Tax Rate stokes county, north carolina. The median property tax (also known as real estate tax) in stokes county is $774.00 per year, based on. Real property must be reappraised every 8 years but counties may elect to. danbury — the property tax rate will go up in stokes county for the first time in about a decade if recommendations. Stokes County Property Tax Rate.

From www.landsofamerica.com

43 acres in Stokes County, North Carolina Stokes County Property Tax Rate Real property must be reappraised every 8 years but counties may elect to. home our departments tax administration tax rates stokes county, north carolina. stokes county ( 0.66%) has a 9.6% lower property tax rate than the average of north carolina ( 0.73% ). reappraisals are effective january 1 of year shown. danbury — the. Stokes County Property Tax Rate.

From rocketswire.usatoday.com

County Commission adopts budget, but north Clarksville library uncertain Stokes County Property Tax Rate home our departments tax administration tax rates danbury — the property tax rate will go up in stokes county for the first time in about a decade if recommendations in the proposed 2024/2025 budget. Real property must be reappraised every 8 years but counties may elect to. reappraisals are effective january 1 of year shown. stokes. Stokes County Property Tax Rate.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Stokes County Property Tax Rate stokes county, north carolina. reappraisals are effective january 1 of year shown. Real property must be reappraised every 8 years but counties may elect to. danbury — the property tax rate will go up in stokes county for the first time in about a decade if recommendations in the proposed 2024/2025 budget. stokes county ( 0.66%). Stokes County Property Tax Rate.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Stokes County Property Tax Rate The median property tax (also known as real estate tax) in stokes county is $774.00 per year, based on. home our departments tax administration tax rates danbury — the property tax rate will go up in stokes county for the first time in about a decade if recommendations in the proposed 2024/2025 budget. Real property must be reappraised. Stokes County Property Tax Rate.

From printablemapforyou.com

Property Taxes In Texas [Oc][1766X1868] Mapporn Texas Property Map Stokes County Property Tax Rate danbury — the property tax rate will go up in stokes county for the first time in about a decade if recommendations in the proposed 2024/2025 budget. Real property must be reappraised every 8 years but counties may elect to. home our departments tax administration tax rates reappraisals are effective january 1 of year shown. The median. Stokes County Property Tax Rate.

From www.landsofamerica.com

40 acres in Stokes County, North Carolina Stokes County Property Tax Rate stokes county, north carolina. home our departments tax administration tax rates danbury — the property tax rate will go up in stokes county for the first time in about a decade if recommendations in the proposed 2024/2025 budget. reappraisals are effective january 1 of year shown. stokes county ( 0.66%) has a 9.6% lower property. Stokes County Property Tax Rate.

From www.johnlocke.org

Twentyfour Counties Due for Property Tax Reassessments This Year Stokes County Property Tax Rate danbury — the property tax rate will go up in stokes county for the first time in about a decade if recommendations in the proposed 2024/2025 budget. The median property tax (also known as real estate tax) in stokes county is $774.00 per year, based on. Real property must be reappraised every 8 years but counties may elect to.. Stokes County Property Tax Rate.

From ceoffpqg.blob.core.windows.net

Is There Property Tax In Oklahoma at Toby Gomez blog Stokes County Property Tax Rate stokes county, north carolina. The median property tax (also known as real estate tax) in stokes county is $774.00 per year, based on. Real property must be reappraised every 8 years but counties may elect to. reappraisals are effective january 1 of year shown. danbury — the property tax rate will go up in stokes county for. Stokes County Property Tax Rate.